An employer’s responsibility for a former employee’s unemployment benefits is determined using a specific calculation based on the calendar. The earnings of the former employee during the Base Year are used to compute the maximum benefit amount.

Base Year is defined as the first four of the last five completed quarters prior to applying for benefits – helps determine maximum amount of benefits. Employers are notified via the NOTICE TO BASE YEAR EMPLOYER

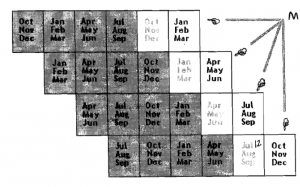

Example Using Chart Below

- Employee leaves district in November 2011

- Applies for benefits in January 2013

- District liable for some benefits because base year is from October 2011 – September 2012

- District considered Base Year Employer